Property Taxes in Winston-Salem, NC

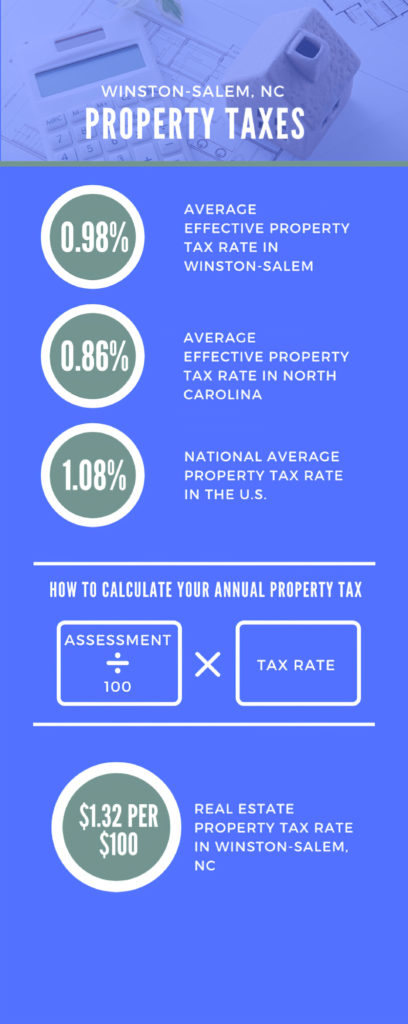

Property tax rates in North Carolina are relatively low compared to similar tax rates in other states across the country. North Carolina’s average effective property tax rate is 0.86%, which is well below the national average of 1.08%. Winston-Salem is the largest city in Forsyth County, North Carolina. Forsyth County’s average effective property tax rate is 0.98%.

Property taxes in the state of North Carolina are a significant source of revenue for local governments. The revenue generated through taxes is a crucial source of funding for services like law enforcement and public education.

How North Carolina Property Taxes Work

Property tax in North Carolina is described as “ad valorem.” This means property taxes in the state are calculated based on the value of each property.

A county assessor is responsible for determining the value of a property and is mandated by law to revalue the property at least once every 8 years. The essence of the revaluation is to ascertain the present market value of the said property.

Counties and cities have the right to levy their own taxes. In some areas, special tax districts collect property taxes for services such as fire protection.

Since a homeowner will be required to pay property taxes based on the most current valuation for as many as eight years, it is absolutely crucial to ensure than the valuation is an accurate reflection of the property’s worth. If the appraisal is extremely higher than the actual value of the property, the homeowner will end up with almost a decade of over-taxation.

Since properties aren’t frequently assessed in North Carolina, access values could be significantly different from the actual value of the property. This makes it difficult to compare tax rates in different areas.

This is why the state’s effective property tax rate is considered a strong benchmark. An effective tax rate indicates the annual property taxes paid as a percentage of overall home value.

Winston-Salem Property Tax Rates

Forsyth County is the fourth most populous county in the state of North Carolina. Winston-Salem is one of the cities in Forsyth County and of the best places to live in the entire North Carolina. You can take a look at the various neighborhoods in Winston-Salem and homes available for sale.

Forsyth County property tax rates are slightly higher than the state’s average. Forsyth County’s average effective property tax rate is 0.98% which is rated 21st among the 100 counties in the state. Meanwhile, the state’s effective property tax rate is 0.86%.

The county’s most recent revaluation was done in 2017. Forsyth County revalues properties more often than the state of North Carolina minimum – eight years. Forsyth County revalues properties every four years.

The 2019 – 2020 property tax rates in Forsyth County are $0.7535 per $100 of valuation. However, within Winston-Salem City limits, a further assessment of $0.6374 per $100 of valuation is done.

Forsyth County has no school district taxes. Also, manufacturers and wholesalers’ inventories are exempted from property taxation in the county.

Winston-Salem Sales Tax Rate

If you’re considering selling your real estate property now or anytime in the future, you should be aware of Winston-Salem sales tax rates and its real estate market report.

Winston-Salem’s minimum combined sales tax rate for 2020 is 6.75%. This indicates the overall amount of state, county and city sales tax rates. The current sales tax rate in the state of North Carolina is 4.75%. The sales tax rate in Forsyth County is 2%, while Winston-Salem sales tax rate is 0%.

How To Appeal Property Tax Assessments In Winston-Salem

If you disagree with the revaluation of your property in Winston-Salem or any other area of North Carolina, you have the right to appeal to the local Board of Equalization. You should also consider reaching out to local officials before you file an official appeal. Some of such controversies can be resolved informally.

If you intend to file an appeal, learn about important dates and schedules for appeal and you can download the 2020 Appeal To The Forsyth County Board of Equalization and Review form to get started.

Exclusive of an appeal, the local tax rate is applicable to the assessed value as established by the county assessor. Senior citizens in the state may qualify for property tax exemption which lowers their home’s assessed value by as high as 50% or $25,000. Seniors with an overall income of $30,200 or less were qualified for this exemption in 2019.

Winston-Salem Property Tax Deadline

In Winston-Salem, all real estate tax bills are mailed to all homeowners and other real estate property owners in July of every year. If you’re yet to get your tax statement by September 15, you’re required to reach out to the Tax Collector’s office during regular office hours.

The Tax Collector’s Office is exclusively responsible for the collection of fees and taxes. However, if you have any questions about assessed values, billings, and listings, contact the Tax Assessors Office.

Real estate property taxes in Winston-Salem are due on September 1 and you can make payments until January 5. Nonetheless, in the event that January 5 falls on a Saturday or Sunday, the payment deadline is postponed to the next business day.

Winston-Salem Accepted Tax Payment Method.

You can pay your real estate property taxes in Winston-Salem using any of the payment methods listed below:

- Cash (U.S. Currency)

- Personal Check (payable to Forsyth County Tax Collector’s Office) NO third-party checks

- Money Order (payable to Forsyth County Tax Collector’s Office)

- Cashier’s Check (official bank check payable to Forsyth County Tax Collector’s Office)

- Electronic Check (online-see details below)

- Credit Card (online-see details below)

Pay by mail

If you intend to pay by mail, add a copy of your tax bill and/or your tax bill account number on your check. To avoid interest, you’re advised to make your mail payment within 5 business days prior to the past due date. You’re mandated to make your check payable and then mail it to:

Forsyth County Tax Collector

P.O. Box 82

Winston-Salem, NC 27102

Pay by phone

You can pay your real estate property taxes via phone by using a credit card or a checking account. The number to dial is 1-877-215-0165. Before you call, make sure you have your checking account number, bank routing transit number and your12-digit tax account number.

Pay online

In Forsyth County, you can pay your real estate property taxes online by check or by credit card. If you decide to pay by check, you’re required to have your bank routing number as well as your checking account number. If you opt for this payment method, be aware that it takes two to three business days before it gets to the Tax Office. Learn more about Forsyth County property tax online payment methods.

Pay in person

You may decide to pay in person. If you prefer this option, you’ll have to visit the Tax Collector’s Office from Monday – Friday (excluding holidays) within the hours of 8:00 a.m. and 5:00 p.m. The address is

Forsyth County Government Center

201 North Chestnut Street

Winston-Salem, NC 27101

You can also find a payment drop box on the exterior wall of the government building opposite Chestnut Street close to the parking deck entrance.

For more information about real estate property taxes in Winston-Salem, or if you need a real estate expert for any other reason, don’t hesitate to contact me.

No Comments