Closing Costs in Winston-Salem, NC

What are Closing Costs?

In the event that the buyer and the seller have both reached an agreement with regards to the home being sold, the next and final stage in the home sale process is the closing, which is also called settlement. During this stage, the buyer and the seller sign the final ownership and insurance documents and pay the fees that are due upon the settlement of the real estate sale, called closing costs, thereby making the buyer the legal owner of the house.

Typically, most of the closing costs are the buyer’s responsibility. However, closing costs are not always set in stone, and the buyer may negotiate with the seller to cover some of these costs. The fees and legal requirements are not the same for every state and municipality, so it is best for homebuyers to learn more about these prior to making an offer to the seller.

Average Closing Costs in Winston-Salem, NC

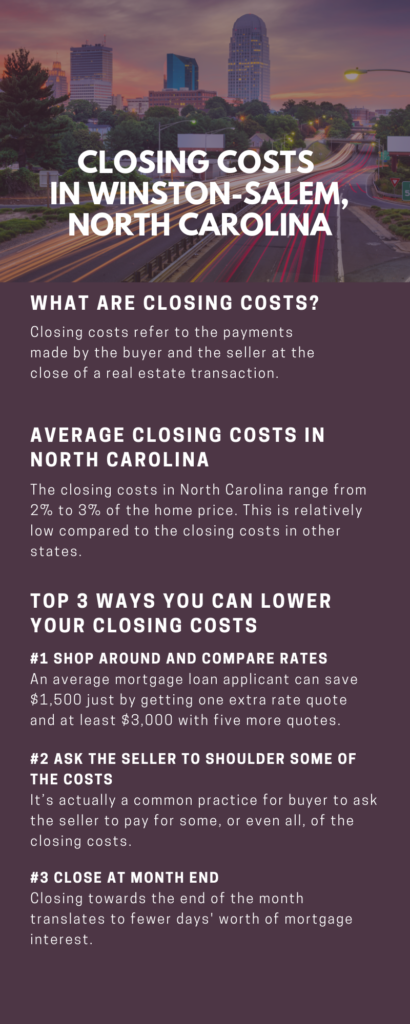

The closing costs in North Carolina range from 2% to 3% of the home price. This is relatively low compared to the closing costs in other states. Another advantage for homebuyers in North Carolina is, the state does not charge a mortgage tax. However, they will have to pay an additional fee for title insurance, since most lenders require this insurance policy to protect their interests in case of a title dispute.

Some of the closing costs are paid to the mortgage lender, such as fees for underwriting, processing, broker services, document preparation, origination points and commitment. Also included in closing costs is the home inspection cost, which is estimated at $350 to $500. The cost may be more if the buyer opts to avail of add-on tests, such as mold, radon, termite, and infrared inspections. While these inspections are not required, it is to the buyer’s best interest to have these performed prior to making their financial decision of buying a home. In addition, doing so may even help the buyer negotiate the asking price or repairs. The buyer will also have to pay for a credit report, appraisal, attorney, flood insurance, and survey.

Included in the buyer’s closing costs are property taxes, which are usually about 0.84% of the home value. North Carolina’s property taxes rank the 20th-lowest effective tax rates in the nation. After taxes, the next thing a homebuyer needs to consider is the homeowners insurance. The average cost of a policy in North Carolina is $1,117 per year, which is quite affordable compared to the rest of the nation.

Breakdown of Closing Costs in North Carolina

-

Home Inspections

-

Surveys

-

Property Taxes

-

Property Association Dues

-

Attorney Fees

-

Title Insurance Policy Fee

-

Hazard Insurance

-

Lender Fees

-

Flood Zone

-

Certification Fees

-

Fee to Record the New Deed

-

Attorney Fee

-

Tax Stamps

-

Property Taxes

-

Property Association Dues

-

Real Estate Commission

-

Any Costs the Seller Agrees to Share with the Buyer

How Can Winston-Salem, NC Homebuyers Lower Their Closing Costs?

Going through the list of closing costs can be quite overwhelming, especially if you are a first time homebuyer. However, most of these fees and charges are negotiable and there are a few steps you can take to reduce your closing costs. Below are a few practical tips for homebuyers like you to help you get a better deal from your Winston-Salem home purchase:

1. Get a Rebate on the Broker’s Commission

While most homebuyers simply negotiate for a lower broker’s fee, you can also work with a brokerage firm that offers a rebate on its commission to further lower your closing costs. You may offer to do some of the legwork, such as viewing properties without a broker, in exchange for a percentage of the commission paid to the broker at closing.

2. Do Some Research on the Fees and Charges Involved at Closing

It pays to be knowledgeable about the fees and charges involved at closing. Being familiar with these costs can greatly help you think of ways to structure the deal, negotiate to take out certain fees that seem vague or unnecessary, and consequently minimize your total closing costs. Take the mansion tax, which is applicable for home purchases of more than $1 million, for instance. Knowing this information would motivate you to negotiate for a home sale price that is lower than $1 million so you can avoid this cost.

3. Wait for a Resale in New Construction

Usually, homebuyers prefer to buy new construction; but these new houses would typically sell for a higher purchase price and, in effect, higher closing costs. So, instead of buying new construction, it may be more practical for you to choose a slightly used property or consider waiting for the first resale in new construction.

4. Shop Around for Lenders and Compare Their Rates

Different lenders offer different rates, so the best way for homebuyers like you to get the best rate is to shop around and compare rates. The variance among interest rates ranges from one-eighth percent to a half-percent, which may seem to be small but a half-percent interest on a $500,000 loan would mean an annual savings of $2,500. According to a recent study, a homebuyer can save as much as $1,500 by getting one extra rate quote when applying for a home mortgage and at least $3,000 by getting five quotes from different lenders. If investing some time and effort to shop around and compare rates can double your savings, then it should definitely be worth it.

5. Set Your Closing Date Towards the End of the Month

You can further reduce certain costs by scheduling your closing date towards the end of the month, such as prepaid daily insurance charges. By doing this, you can reduce your cash outlay for prepaid or “per diem” interest as the period between your loan closing and the beginning of the next month is shorter. To compute for your savings, simply multiply your loan amount by your interest rate then divide the result by 365 to get your daily interest charge. Next, multiply that figure by the days left in the month to see how much you will be saving.

If you are planning to purchase a home in Winston-Salem, North Carolina, I can show you all the best options available for you and help ensure a smooth process all the way to closing. Feel free to give me a call at 336.978.4745 or send me an email at [email protected].

Reed Hyman

September 25, 2019 at 1:38 pmHi! This is my first visit to your blog! We are a collection of volunteers and starting a new initiative in a community in the same niche. Your blog provided us valuable information to work on. You have done a outstanding job!

Bill Rouse

October 3, 2019 at 7:47 pmThanks for taking the time to read and post. All the best to you

Jona

October 3, 2019 at 7:32 pmI visited various blogs except the audio quality

for audio songs current at this web site is really superb.

I needed to thank you for this excellent read!! I certainly loved every bit of it.

I have got you book-marked to check out new things you I have been browsing online more than 4

hours today, yet I never found any interesting

article like yours. It is pretty worth enough for me.

Personally, if all site owners and bloggers made good content as you

did, the web will be much more useful than ever before. http://car.com

Bill Rouse

October 3, 2019 at 7:46 pmThank you so much. Thanks for commenting. I really appreciate that 🙂